At DESCONTEL Consulting, we have Services of Consultancy for the Banking sector as we have experience and capacity to integrate and enrich the value chain of our customers.

With them we work, side by side, in the implementation of solutions of business, looking for reach competitive advantages and improving a growth sustained.

The “Cash Management" concept is vital to the Company and its strategy. As part of the strategic management of the Company, "Cash Management" considers financial risk calculations (risk management). Increase the profitability of liquid resources, minimizing transaction costs and maximizing interest income.

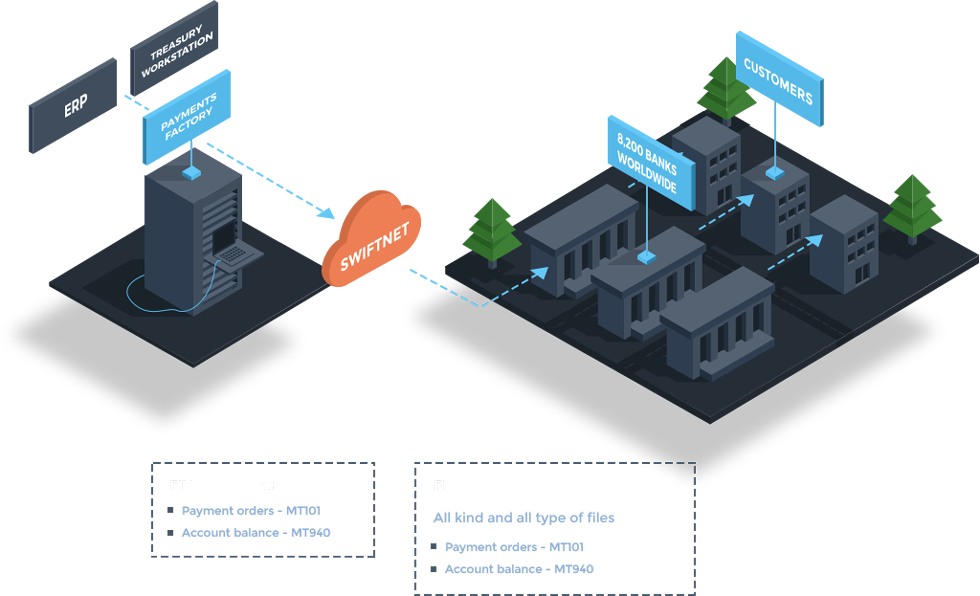

D-Cash is a solution of Treasury Management for Business (Enterprises), presents information on accounts with maximum availability.

The service allows you to manage balances headquartered Company accounts in other banks worldwide.

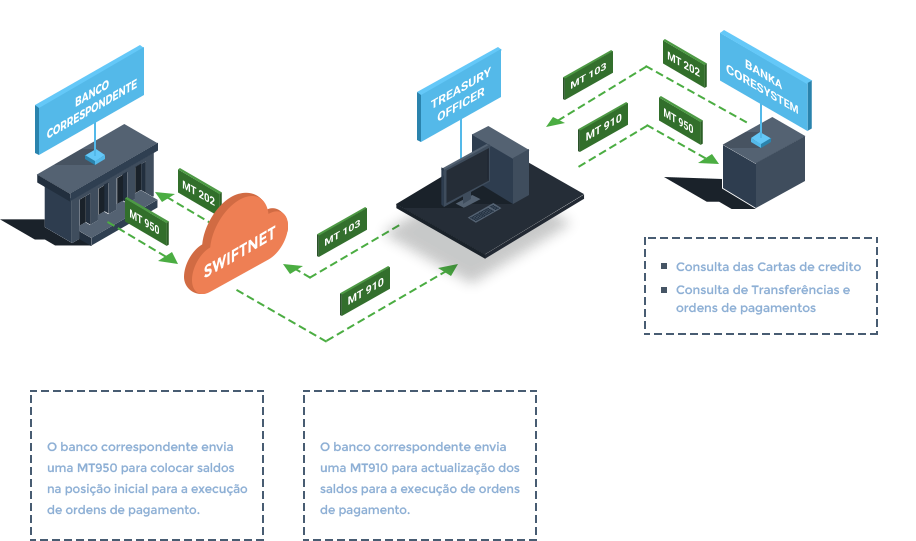

The Liquidity concept is vital to Institutions in the financial and capital markets. Banks are looking to mitigate risk through active liquidity management and apply end to end business management principles to intraday liquidity. Optimize workflows and matching incoming and outgoing flows at a more granular and business level. Become more efficient and rethink FIFO approach.

In the management of Financial Institutions, Liquidity refers to the speed and ease which an asset can be converted into cash. In fact, the liquid has two dimensions: ease of conversion versus loss value. The currency is regarded as the most liquid asset, but it is an imperfect store of value. When there is a general rise in prices in the economy (inflation), for example, the value of money falls.

In the management of Financial Institutions, Liquidity refers to the speed and ease which an asset can be converted into cash. In fact, the liquid has two dimensions: ease of conversion versus loss value. The currency is regarded as the most liquid asset, but it is an imperfect store of value. When there is a general rise in prices in the economy (inflation), for example, the value of money falls.

D-Cash Bank - is a solution of Auto Balances Concentration, multi-Bank and multi-Country, that allows knowledge of the concentration of fund positions. Uses SWIFT messages to check the positions of the various accounts and initiate funds transfers based on predefined rules. Sweeping frequency: daily, weekly, monthly and inter-daily.

Available conditions of Maximum Balance Treshold (Push), Minimum Balance Treshold (Pull) and Target / Zero Balance (Push & Pull).

The service allows you to manage balances headquartered Company accounts in other banks worldwide.

We aim to be at the forefront of Intraday Liquidity Management space, engaged with regulators, industry groups and service providers

The IF`s are facing increasingly larger quantities of information , experiencing greater complexity formats It is a business intelligence solution for the financial sector that provides access to and management of its financial messages efficiently, safe and cost-effective

This solution gives the organization a centralized solution for access to your entire file / data back up , the long-term files , allowing to obtain fast and easy way to messages , reporting in accordance with regulations , business intelligence and monitoring in real time

Provides IF`s a centralized solution for access to its internal and external data messages , allowing for high performance on demand for reporting and creating tables

It supports integration in real time to allow an almost real file preview

The search functions can be accessed using form based searching and through faceting to provide a rich searching experience.

The reporting function provides access to the messaging data supporting the full richness of the messaging standards used.

Defined dashboards provide a aggregated view on messaging data. Dashboards provide both numerical and graphical perspectives on the underlying data.

A solution for the installation of an order management service to different organs, so that it was possible to know, at any time

The solution to be proposed should meet the following criteria:

According to industry best practices DCTEVO provides Manage Engine Plus - Sevice Desk with the following advantages:

A solution for the installation of an order management service to different organs, so that it was possible to know, at any time

This is especially true after upgrading back office applications (upgrades and updates) to a new version or changes in the main data of the organization. Irreversible damage can be caused by subsequent financial penalties and reputation implications for the organization. The Screener Compliance solution allows the system to find detectable compliance issues payment instructions generated by the bank.

The solution takes into account the compliance with rules on payments processed - held once or regularly. The Compliance Screener solution can analyze a full day or even different months of payments being tailored to the customer's interest.

This assay has a very high probability of detecting the main issues. It is an ideal tool to increase compliance issues of protection and ideally complements the traditional tests.

To impose sanctions and combat terrorism, the need for transparency of payments increased significantly. Each bank in the payment chain should conduct their own efforts to detect any payments that may be in conflict with the laws of their own country. To do so, the information must be complete and must be contained in the payment instructions.

A key element to provide this transparency is the correct use of a solution to verify that the payment messages contain all the necessary information. A proactive and automated compliance test helps to capture any problems in time.

AMLCheck, is composed of 3 modules, called screening, KYC and Profiling solution. The annual cost of servicing, is set according to the number of clients that an institution , setting this value , the maximum number of batch or regular consultations